©2019 ICE Data Pricing & Reference Data, LLC

May not be reproduced by any means without express permission. All rights reserved.

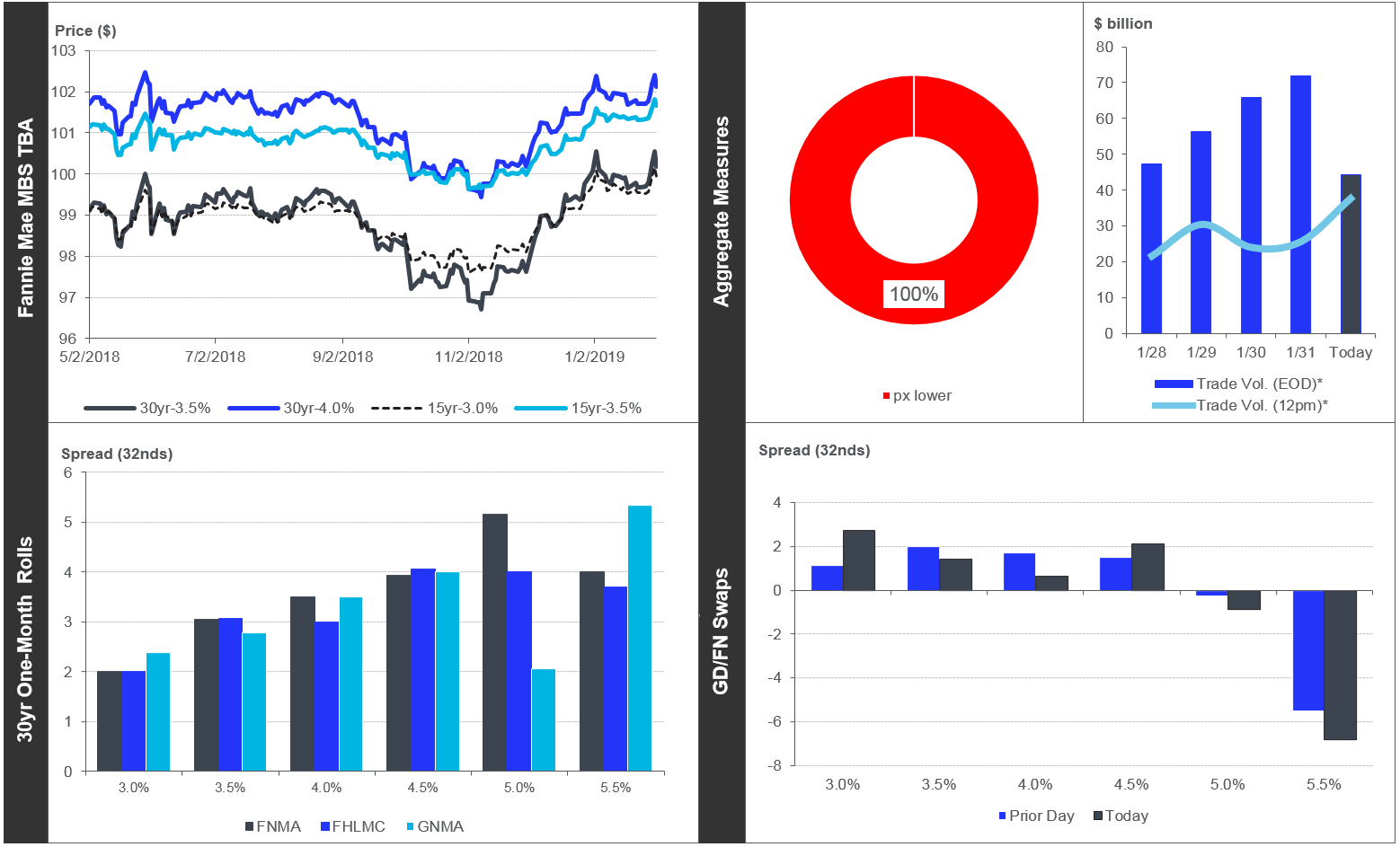

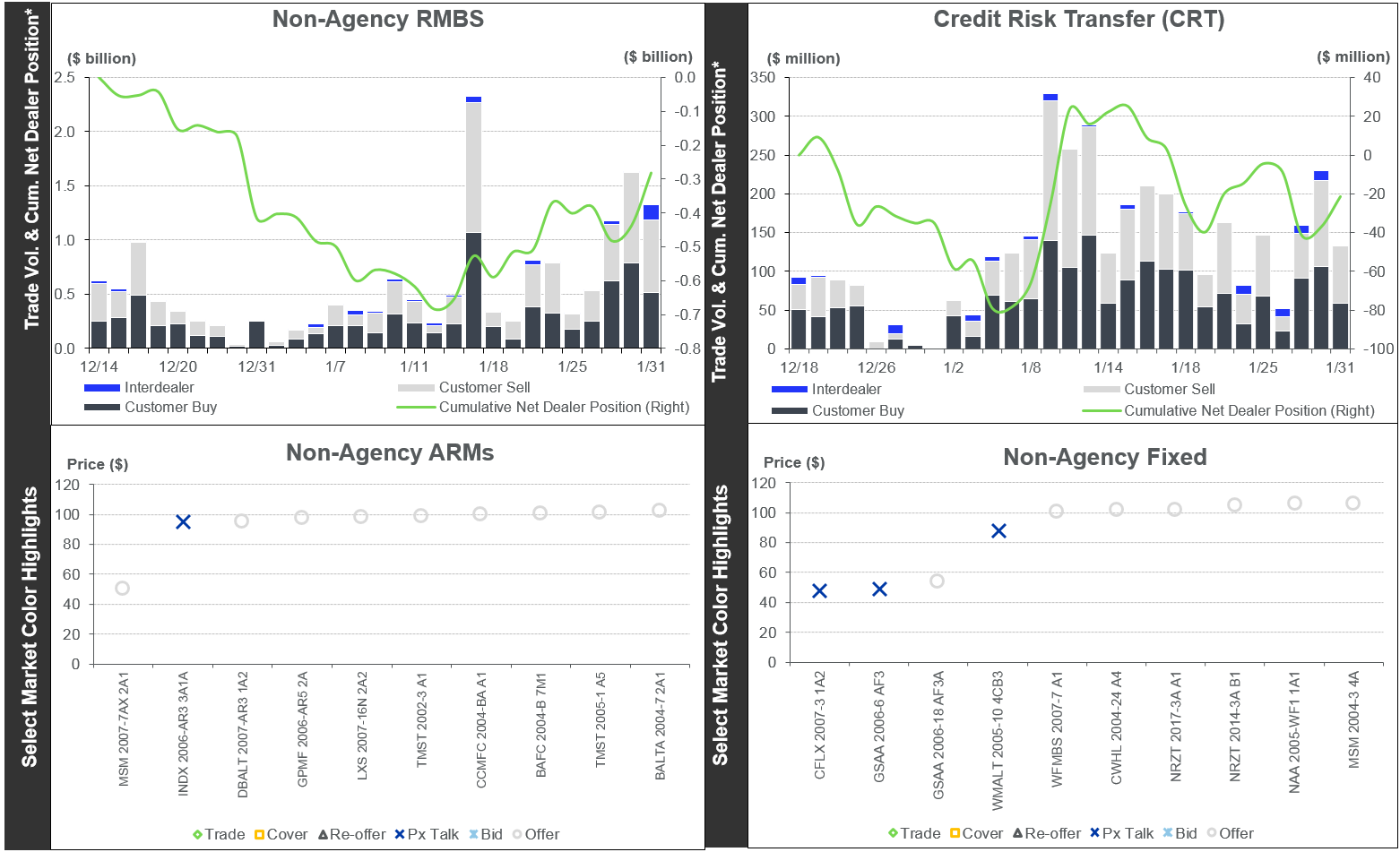

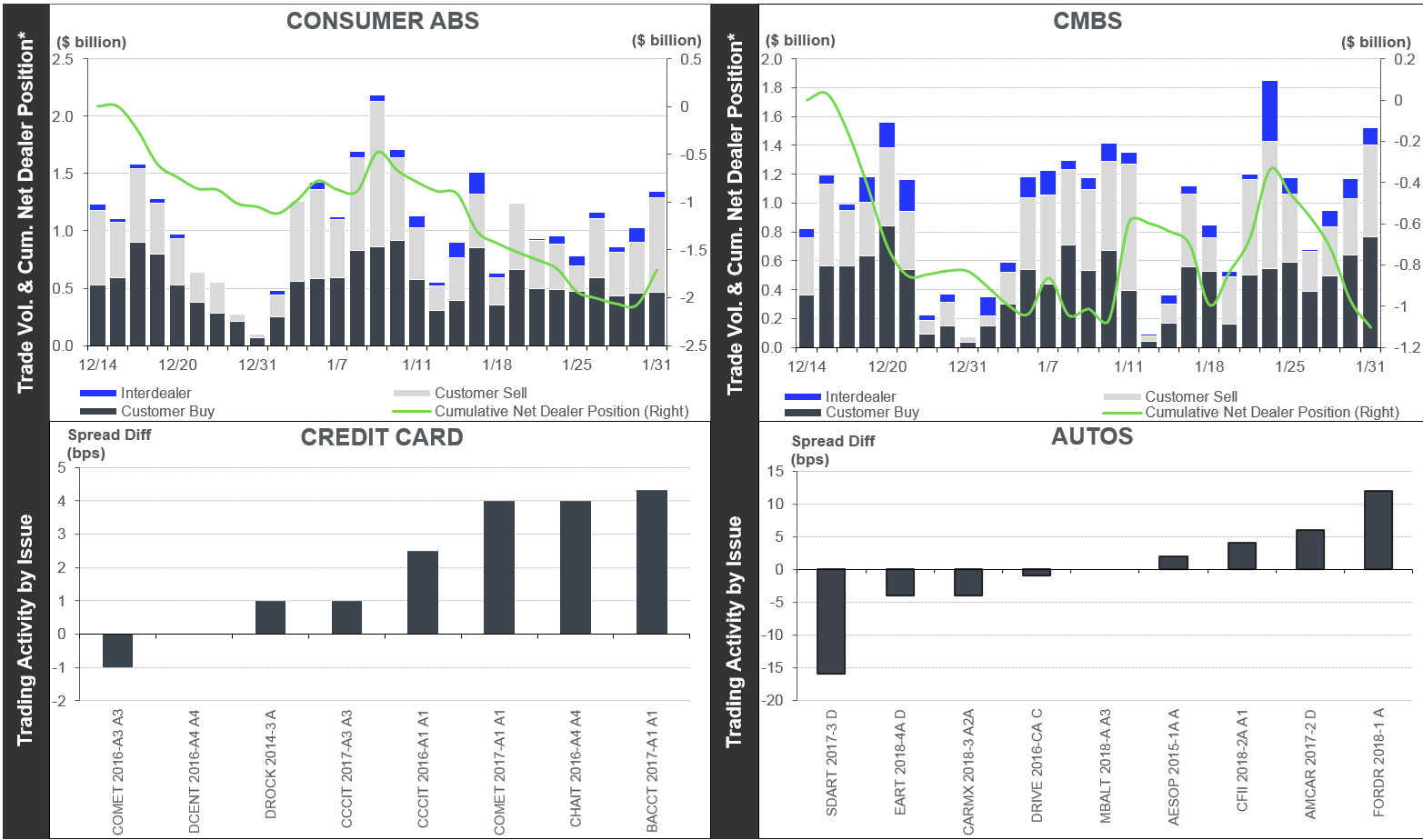

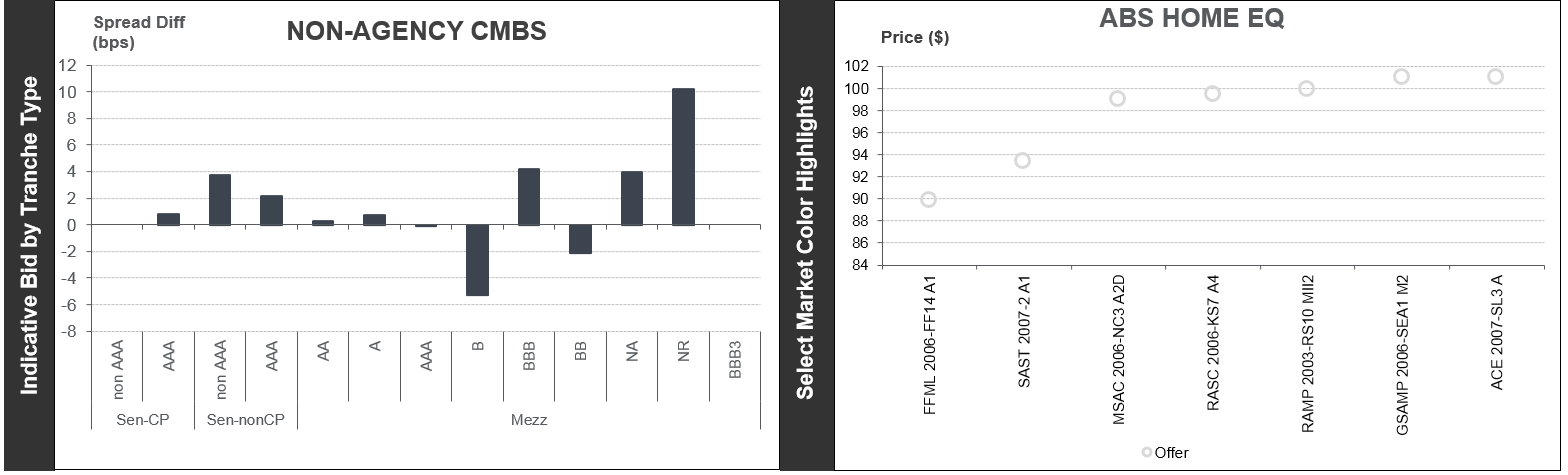

*Trading Volume Source: FINRA® TRACE®

This document is provided for informational purposes only and is not an offer of advisory services or investment advice. This document represents ICE Data Pricing & Reference Data, LLC's ("ICE Data Pricing") observations of general market movements. Trades and/or quotes for individual securities may or may not move in the same direction or to the same degree as indicated in this document. This document is not meant to be a solicitation, or recommendation to buy, sell or hold any securities. The information contained in this document is subject to change without notice and does not constitute any form of warranty, representation, or undertaking.

ICE Data Pricing makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. Without limiting the foregoing, ICE Data Pricing makes no representation or warranty that any data or information (including but not limited to evaluations) supplied to or by it are complete or free from errors, omissions, or defects. ICE Data Pricing does not provide legal, tax, accounting, or other professional advice. Clients should consult with an attorney, tax, or accounting professional regarding any specific legal, tax, or accounting situation.

ICE Data Services is the marketing name used to refer to the suite of pricing, market data, analytics, and related services offered by Intercontinental Exchange, Inc. (NYSE:ICE) and certain of its affiliates, including ICE Data Services, Inc. and its subsidiaries globally, including ICE Data Pricing & Reference Data, LLC, Interactive Data (Europe) Ltd. and ICE Data Services Australia Pty Ltd.

Moody’s® is a registered trademark of Moody’s Investor Service, Inc.

S&P Ratings Limitations: Copyright 2016, Standard & Poor’s Financial Services LLC (“S&P”). Reproduction of RatingsXpress-Credit Ratings in any form is prohibited except with the prior written permission of S&P. S&P does not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and is not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of ratings. S&P GIVES NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. S&P SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTIAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, or LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS) IN CONNECTION WITH ANY USE OF RATINGS. S&P’s ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the market value of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

Trademarks of Intercontinental Exchange, Inc. and/or its affiliates include: Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, ICE Data and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located at www.intercontinentalexchange.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.