Home of ETFs

Where investors come to learn from ETF experts from across the NYSE community.

Discover the ultimate destination for ETF investors

Search, compare, and learn about all things ETF

Brought to you by

ETF Feature

The Exchange

Alexa Gordon, Fixed Income Portfolio Manager, Goldman Sachs Asset Management

Alexa Gordon speaks with Douglas Yones, Head of Exchange Traded Products at the New York Stock Exchange.

ETF Expert Corner

Hear from the ETF experts as they provide their latest perspectives on the evolving ETF marketplace.

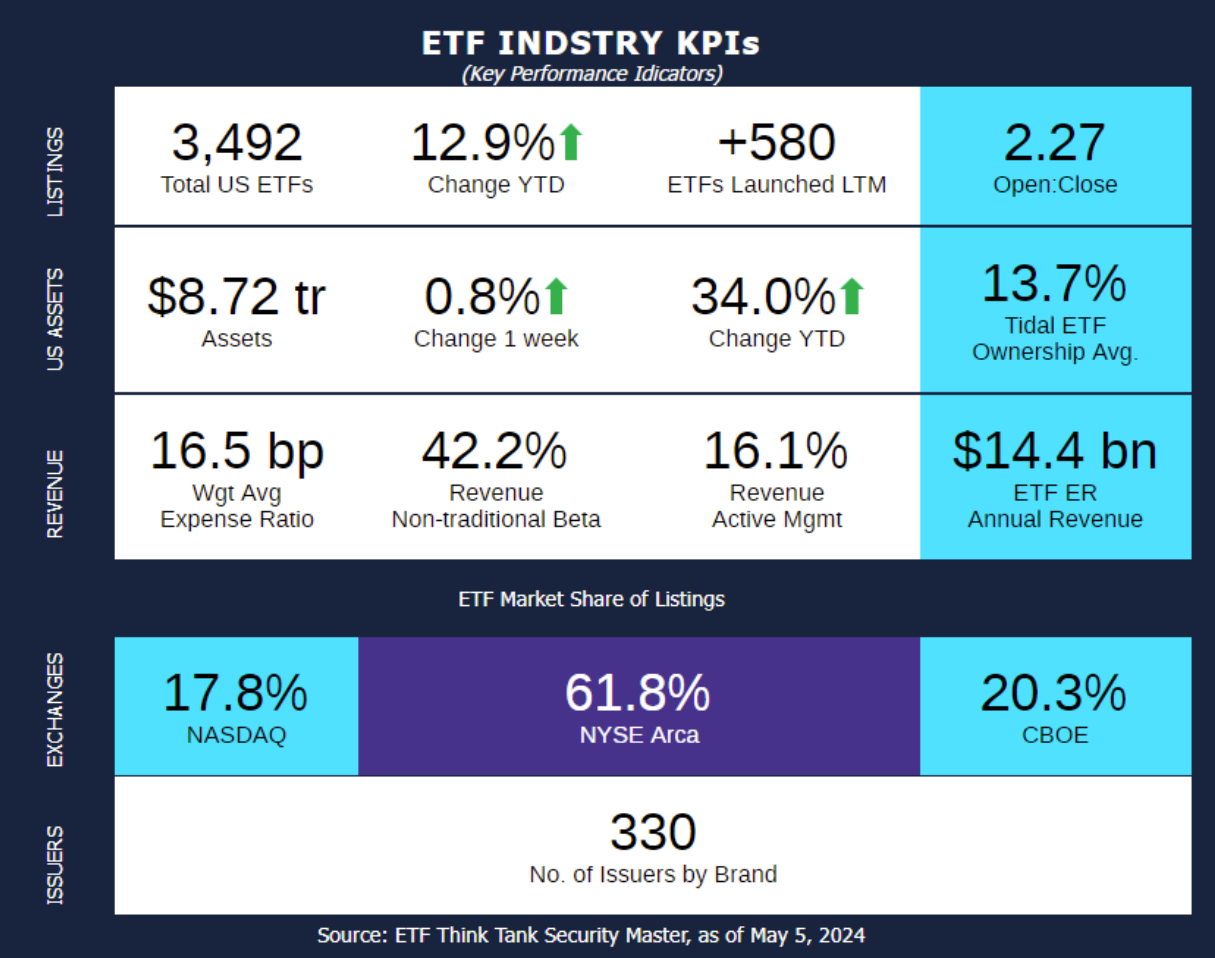

Week of April 29, 2024 KPI Summary

- This week, the industry experienced 15 ETF launches and 0 closures, shifting the 1-year Open-to-Close ratio to 2.27 and total US ETFs to 3,492.

- 2024 ETF GRADUATION: For millions of high school and college students across the United States, May means graduation! Most students take 4 years to graduate, so we are going to examine the top ETFs that were launched in 2020.

- 257 ETFs are still open that were launched in 2020, totaling $216.2 Billion which is about 2.5% of the ETF industry total AUM.

- Equity ETFs make up 50% of the funds (128) yet 45% of the AUM. Additionally, Fixed Income is 20% of the funds but 47% of the AUM.

- The only $1B+ fund outside of Equities and Fixed Income funds is BUFR, First Trust Cboe Vest Fund of Buffer ETFs; an Options fund at $3.97 Billion.

- The largest fund by AUM of 2020 is currently Vanguard US Trsry 0-1 Yr Bd ETF MXN HAXX (VMSTx) at approximately $43.1 Billion. The next 4 in order are JEPI, QQQM, SGOV, & JAAA. These 5 funds make up $128.6B, approximately 59.5% of total 2020 ETF AUM.

- Worth noting that in the top 10: Dimensional has 3 funds, iShares has 2, and 5 other issuers each have 1.

- iShares has the most 2020 ETFs still live at 35 funds.

- The fund with the best 3-year asset performance (many 4-year outlooks are incomplete) is ETRACS Quarterly Pay 1.5X Leveraged Alerian MLP Index ETN (MLPR) at 32.4%.

- In fact, UBS ETRACS funds constitute 4 of the top 5 3-year performers, ranging from 14-32% growth.

- Of the 148 Actively Managed ETFs:

- JPMorgan Equity Premium Income ETF (JEPI) is the largest at $33B.

- Fidelity® Fundamental Large Cap Core ETF (FFLC) has the top 3-year performance at 13.7%.

- Lastly, who had the best final semester of their senior year? The top performer YTD has been (by far) AdvisorShares Pure US Cannabis ETF (MSOS) at 38.9%, with the next best at 18.2% (WUGI).

- Congratulations to all the 257 ETFs graduating this year, especially the ones graduating with honors mentioned above! Our graduating class is a bit bigger than last year (187), but over 3x larger in terms of assets (~$216B to $70B). Good luck to this “COVID Class” going forward!

- The tracked indexes had similar experiences in the last few years. Over a 3-year period, The Toroso ETF Industry Index is up 4.75% while the S&P Financial Select Sector Index led at 5.71%.

The Exchange

Ignacio Canto, President, X-Square Capital

What's the Fund

Vanguard - VTES

Vanguard Portfolio Manager Steve McFee talks to us about Vanguard Short-Term Tax-Exempt Bond ETF (NYSE Arca: VTES).

ETF 360

ProShares - SPXN

Simeon Hyman, Global Investment Strategist and Head of Investment Strategy at ProShares, along with VettaFi Head of Research, Todd Rosenbluth, discusses the ProShares S&P 500 Ex-Financials ETF (SPXN).

First Look ETFs

Kaiju, Sound Income Strategies (Tidal), Harbor Capital

Recently launched ETFs for our May episode are focused artificial intelligence (AI), high income and dividend strategies and the human capital factor.

The Exchange

Ignacio Canto, President, X-Square Capital

What's the Fund

Vanguard - VTES

Vanguard Portfolio Manager Steve McFee talks to us about Vanguard Short-Term Tax-Exempt Bond ETF (NYSE Arca: VTES).

ETF 360

ProShares - SPXN

Simeon Hyman, Global Investment Strategist and Head of Investment Strategy at ProShares, along with VettaFi Head of Research, Todd Rosenbluth, discusses the ProShares S&P 500 Ex-Financials ETF (SPXN).

First Look ETFs

Kaiju, Sound Income Strategies (Tidal), Harbor Capital

Recently launched ETFs for our May episode are focused artificial intelligence (AI), high income and dividend strategies and the human capital factor.

WTF: #WhatsTheFund

Everything you need to know about the latest NYSE-listed ETFs.

The Exchange

Hear from issuers as they take a deep dive into ETFs and industry topics on The Exchange.

Home of ETFs Contributors